The Ultimate Guide to Choosing a Forex Trading Platform

In the world of Forex trading, the choice of trading platform can make a significant difference in your overall trading experience and success. Therefore, it’s crucial to select a platform that is not only user-friendly but also equipped with the necessary tools and features to enhance your trading efficiency. As you embark on your Forex trading journey, consider exploring forex trading platform Forex Brokers in Indonesia to discover platforms tailored to your local market needs.

This article serves as a comprehensive guide to help you understand the key factors to consider when selecting a Forex trading platform. Whether you are a beginner or an experienced trader, the right platform can facilitate your trading strategy and improve your potential profitability.

Understanding Forex Trading Platforms

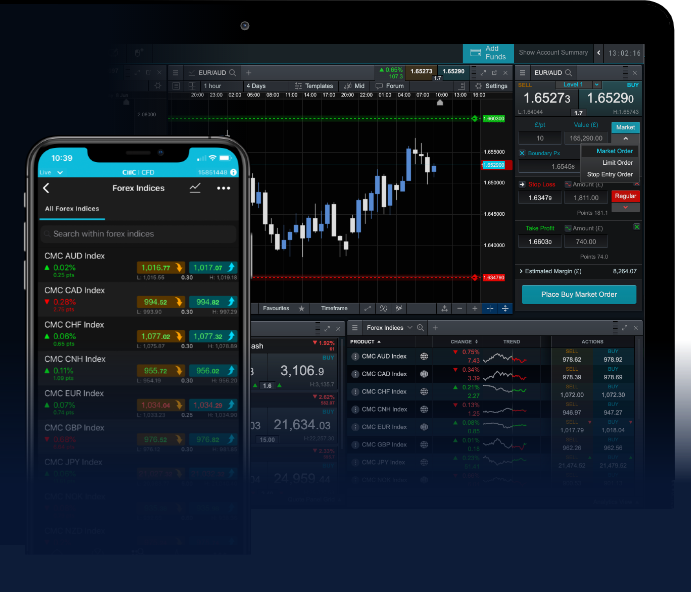

A Forex trading platform is a software application that allows traders to enter, manage, and analyze their trades in the foreign exchange market. These platforms can be desktop-based, web-based, or mobile applications, catering to the varying preferences of traders. Selecting the right platform is essential, as it can impact your trading performance and decision-making.

Essential Features of a Forex Trading Platform

When evaluating Forex trading platforms, certain features stand out as essential for traders:

- User-Friendly Interface: The platform should have an intuitive and easy-to-navigate interface to facilitate seamless trading.

- Charting Tools: Advanced charting tools and technical indicators are crucial for traders to analyze market trends and make informed decisions.

- Customizability: The ability to customize the layout and tools according to personal preferences can enhance the user experience.

- Order Types: A variety of order types, including market, limit, and stop-loss orders, should be available to execute trades effectively.

- Mobile Trading: The option for mobile trading is essential for those who wish to trade on-the-go.

- Demo Account: A demo account allows traders to practice their strategies without risking real money.

- Security Features: Ensure the platform has robust security measures, such as two-factor authentication and encryption, to protect your data and funds.

Types of Forex Trading Platforms

Various types of Forex trading platforms cater to different trading styles and preferences:

1. MetaTrader 4 (MT4)

MT4 is one of the most popular trading platforms in the Forex market. It is user-friendly and supports automated trading through Expert Advisors (EAs). Many traders appreciate its extensive range of technical indicators and charting tools.

2. MetaTrader 5 (MT5)

MT5 is an upgraded version of MT4, offering additional features such as more timeframes, order types, and a built-in economic calendar. It is suitable for traders who require more advanced trading tools.

3. cTrader

cTrader is known for its fast execution speeds and user-friendly interface. It offers a variety of trading tools, making it a favorite among scalpers and day traders.

4. Proprietary Platforms

Many brokers develop their proprietary trading platforms, combining unique features tailored to their clientele. These platforms may offer innovative tools and seamless integration for specific trading needs.

Factors to Consider When Choosing a Forex Trading Platform

Besides the essential features, various factors should influence your choice of a Forex trading platform:

1. Regulations and Security

Ensure that the trading platform is regulated by reputable financial authorities. Regulation guarantees a level of security for your funds and ensures that the broker adheres to specific operational standards.

2. Fees and Spreads

Different trading platforms have varying fee structures. Assess the spread and commission fees associated with each platform to ensure you select one that suits your budget without compromising on features.

3. Customer Support

Reliable customer support can make a significant difference in your trading experience. Choose a platform that offers responsive and knowledgeable customer service available through multiple channels such as live chat, email, and phone support.

4. Available Markets

Ensure the platform offers a wide range of financial instruments beyond currency pairs, such as commodities, indices, and cryptocurrencies, to diversify your trading portfolio.

5. Education and Resources

Some platforms provide educational resources such as webinars, tutorials, and market analysis. These tools can enhance your trading skills and boost your confidence in making informed trading decisions.

Conclusion

Selecting the right Forex trading platform is a critical step in your trading journey. With the myriad of options available in the market, evaluating the essential features, types of platforms, and factors influencing your choice can help you find the platform that best meets your needs. Remember to leverage demo accounts to test different platforms before committing real funds. This careful selection process will empower you to trade with confidence and improve your potential for success in the ever-evolving Forex market.